Our Stubborn Tax Culture

Even though the Federal Board of Revenue (FBR) appears determined to widen the tax net and is undertaking some unconventional measures as well to rein in the evaders, not much change can be expected from resource mobilisation effort in the year 2012.

One obvious reason for this pessimism is that the country’s legal structure allows too many exemptions and loopholes to certain groups, some of whom unfortunately sit in parliament and are often part of the decision-making process. There is an urgent need to amend the constitution to promote the tax culture. Then, the FBR is not known for efficient and corruption-free work culture and any outstanding scheme to raise revenue can be thwarted by a few greedy officials.

Under the law, income from agriculture, the largest sector, is exempt from tax. Only land tax is allowed and that too by the provinces. The result is that fewer than three million, out of 180 million, pay income tax. And, regrettably, they include low salary employees of the state and private entities.

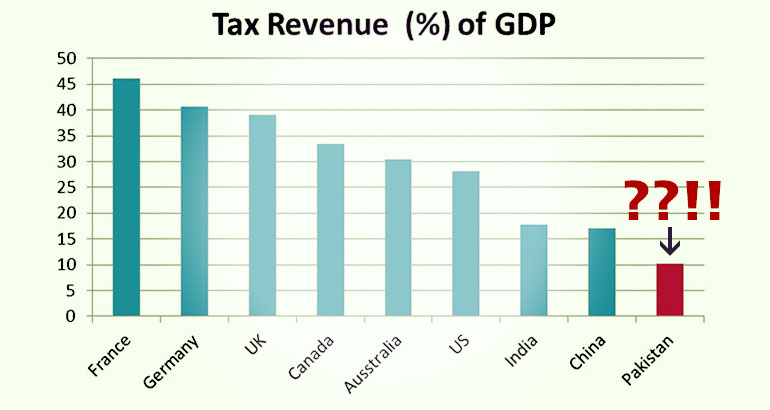

Pakistan’s tax-to-GDP ratio is below nine per cent, which is one of the lowest global rates and worse than much of Africa. About 1.9 million people paid tax in 2010, less than the year before, although 3.2 million were registered as tax-payers. In May this year, the FBR identified a list of 700,000 people, who own more than one house, own cars, travel abroad, have bank accounts but do not pay any taxes.

On December 23, the seventh meeting of the Tax Reforms Core Group held in Islamabad was informed that under the Broadening of Tax Base concept notices have been issued to 295,000 non-filers of tax returns and another 300,000 are expected to be served notices shortly. The FBR gathered the relevant information about them by going through the bills of owners of over three million electricity connections which showed that only 0.7 million of them pay income tax.

More such information may be gathered from gas and phone connections by determining the tax potential of their owners. The FBR chairman, on several occasions, has said that the gap in the tax system is around 79 per cent and the recovery of such revenue could minimise the fiscal deficit and dependence on foreign loans.

In September the FBR, in a similar move to identify non-payers, issued a notification that its electronic system would not accept sales tax and federal excise returns from January 1, 2012 of all those registered manufacturers, importers and exporters who failed to provide computerised national identity card numbers or national tax numbers of their unregistered buyers. The businessmen had resented the FBR decision but the board refused to provide any relaxation in period as it had already given two extensions in dates.

In August this year, the FBR informed the Tax Reform Coordination Group (TRCG) about an alternate strategy aimed at bringing into net new tax-payers. Under this strategy, income from sources such as transfer of shares, sale/purchase of immoveable property will also be taxed and a field survey of business centres will be periodically carried out.

The issue of taxing income from agriculture has been raised by civil society groups, political parties and even the taxation department from time to time during the last four decades but not pursued to its logical conclusion. The landlords argue that they pay land revenue and Usher and that the prices of agriculture commodities are kept artificially low by them, hence there is no need for any further tax.

On December 19, Salman Siddique, chairman FBR, told reporters that almost 60 per cent of the returns filers, out of 36,000 returns filed under the broadening of tax base exercise, have shown no income earned from the agriculture and ten per cent have shown receiving money from abroad in the shape of remittances.

Perhaps, they feared they may be taxed if actual income was mentioned. But they appeared unaware of the fact that the income from agriculture and remittances was exempt from tax.

A State Bank report on June 24 said the agriculture sector produced goods valued at Rs3.698 trillion in the fiscal year 2010-11 which was higher than that of the manufacturing sector but all the income went untaxed.

The manufacturing sector produced total goods worth Rs3.167 trillion. The untaxed agriculture income was 16.7 per cent higher than that of the manufacturing sector which is almost 100 per cent in the tax net. This anomaly has resulted in shifting enormous burden to existing taxpayers and common people who are subject to ever-increasing indirect taxes.

One may recall that the incumbent finance minister and his predecessor have been too vocal in making commitments that there will be no more any ‘no-go areas’ (meaning all exemptions will be withdrawn) and that all taxable incomes, including those of landlords, will be taxed.

On several occasions, Dr Abdul Hafeez Sheikh looked determined to make a break with the past and go ahead with roping in the tax-evading/exempted rich class to pay taxes but then stopped short of coming up with necessary measures. The leading figures of the regime have, incidentally, not shown any such concern, nor initiated any meaningful measures and have apparently preferred to remain uncommitted on the issue.

Originally published in the Daily Dawn. Republished with permission.