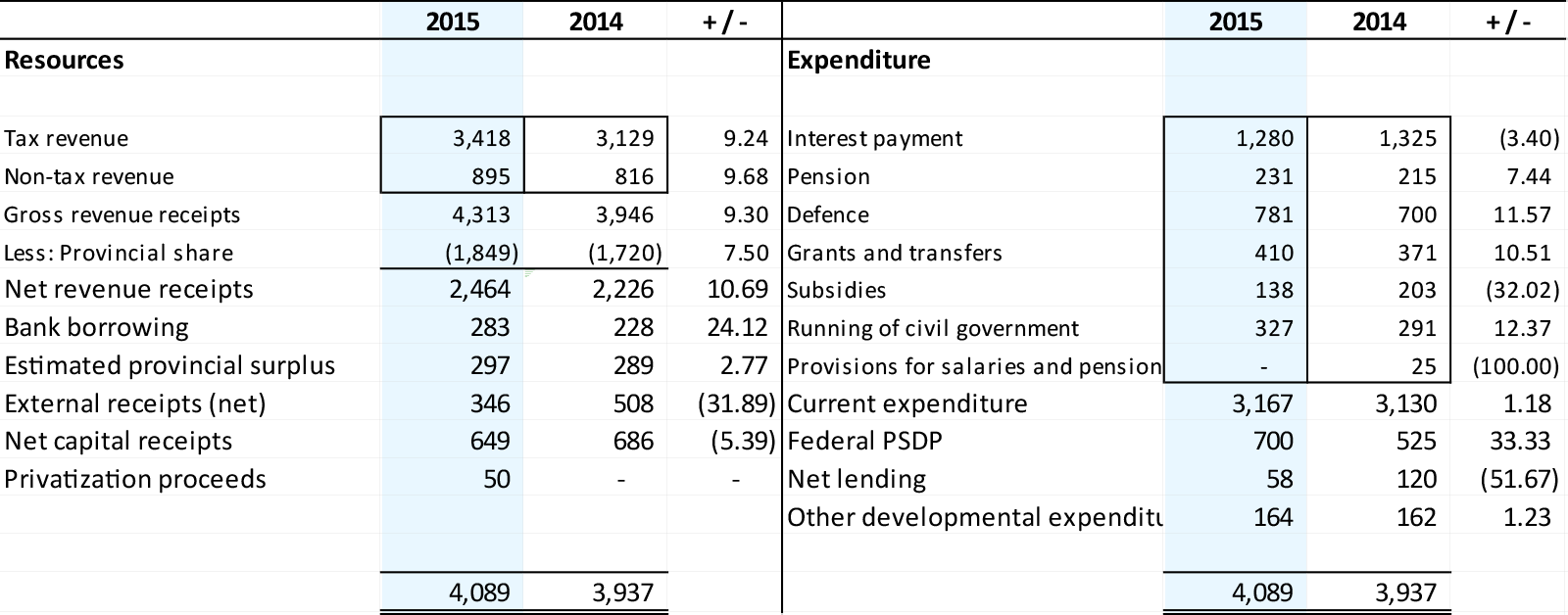

ISLAMABAD (June 06, 2015) – The federal budget for the year 2015-16, with a total outlay of Rs4.089 trillion, was approved by the federal cabinet on Friday.

In his budget speech in parliament, finance minister Ishaq Dar told the house that Rs700 billion have been allotted for the Public Sector Development Programme (PSDP), a 33 percent increase from last year.

Budget spending has been set at Rs4.03 trillion while Rs4.31 trillion are estimated to be collected as tax revenues in the coming fiscal year. Out of this revenue, Rs1.85 trillion will be the share of the provincial governments.

Federal Budget 2015-16 at a Glance

(amounts in billions of rupees)

Salient Features of Federal Budget 2015-16

Gross Domestic Product (GDP): GDP growth rate for the next fiscal has been kept at 5.5 percent which will be taken to around seven percent by end of the current government’s tenure in 2017-18. Finance Minister said GDP growth estimate of 5.5 percent for the next year will be achieved through 3.9 percent growth target for agriculture, 6.4 percent for industries and 5.7 percent for services.

Foreign exchange reserves: Dar said that foreign reserves now stood at USD17 billion which the federal government aims to increase USD 19 billion in the near future.

Public Sector Development Programme (PSDP): Minister said that Rs.700 billion have been earmarked for the development projects to be carried by the federal government while 814 billion rupees will be disbursed among the provinces for their own development programs.

Defense: The defence budget is being increased to 780 billion rupees, an increase of 11 percent, for the next financial year.

Higher education: Rs. 20 billion will be allocated for 143 projects of higher education commission besides allocating 51 billion rupees for the Higher Education Commission for current expenditures.

Taxation: 0.6 percent withholding tax will be imposed on fund transfers and banking instruments, however tax payers who file their returns will be exempted from this tax. Finance minister also announced that tax on dividend will be raised to 12.5 percent from the current 10 percent. Tax on mutual funds will however remain at 10 percent. Advance income tax of 10 percent on utility bills which used to be imposed on bills higher than Rs. 100,000 will now be received on Rs. 75,000.

Tax relief: Rate of tax on companies has reduced by one percent to 32 percent. Profit on projects related to power transmission lines launched before June 2018 is being exempted for a period of 10 years. This is being done to encourage investment in electricity transmission projects. Rate of tax on salaries individuals whose incomes lie between Rs.400,000 and 500,000 is being reduced from the current five percent to two percent. Similarly, rate of tax on non-salaries persons and association of persons in the same income bracket is being lowered to seven percent from the current ten percent.

Sales tax: Federal Excise Duty (FED) on cigarettes is proposed to be increased 63 percent from the current 58 percent. Sales tax on import of mobiles phones is to be increased by 100 percent. Bricks and crush are to be exempt from sales tax for up to 30th of June 2018 to bring down construction costs. Exemptions worth Rs.120 billion under different SROs are being withdrawn. The minister also announced that the power of FBR to issue SROs is being withdrawn and this power will now remain with the federal government to use in special circumstances.

Salaries, pensions and allowances: All government employees will get a 25 percent increase in their medical allowance. Finance minister also announced a grant of 7.5 percent of ad hoc relief allowance in pays and pensions of government employees. He also announced that there would be a 25 percent increase in the medical allowance of pensioners.

Incentives for exporters: Six billion rupees are being allocated in the budget for reconstitution of export development fund. Special incentives will also be given in various sectors of exports, including product diversification, value addition, trade facilitation, enhanced market access and institutional strengthening.

Energy sector: The federal minister said that 248 billion rupees are being allocated for energy sector with an objective to generate additional cheap electricity and overcome load shedding by 2017. He said work is in progress to add 7000 megawatts to the national grid besides another 3600 megawatts through LNG based power plants by December 2017. In addition projects like Dasu, Diamer Bhasha Dam and Karachi nuclear power plants are also being executed to address the energy crisis.

BISP and Bait-ul-Maal: Benazir Income Support Program (BISP) allocations are being enhanced up to 102 billion rupees which will cater to 31 million people of 5.3 million deserving families. Similarly, the budget of Bait-ul-Mal is being doubled from two to four billion rupees.

PM Youth Business Loan Scheme: Under the PM Youth Business Loan Scheme, 15,000 loan applications have been approved while 20,000 applications are under consideration. He said under this scheme, rate of markup is being reduced from eight to six percent in the next fiscal year. The finance minister announced to provide internships to 50,000 unemployed graduates having education of 16 years during the next fiscal year.

Telecommunications: 12 billion rupees are being allocated to set up 217 tele-centers all over the country in the first phase under the “Universal Tele-centers” program. Work is also underway to connect 128 tehsils of the country especially the under developed areas with fiber optic cables.