Opinion

-

Machine Learning for Accountants: A Revolution is Brewing in Financial Reporting

In the rapidly evolving landscape of finance and accounting, Machine Learning (ML) has emerged as a game-changing technology. This powerful…

-

Role of AI and Automation in Developing Cybersecurity Strategies

In the present era of interconnected digital environment, cybersecurity has emerged as a crucial concern for individuals, enterprises, and governments…

-

Blockchain Technology’s Impact on Accounting and Auditing

The development of distributed ledger technology, also known as the blockchain, has called into question traditional business models. One of…

-

Empirically Analyzing the "Five Percent Rule of Materiality" in Financial Reporting Decisions

This study analyzes a sample of financial restatements from 2011 and 2012 as a way to assess a proposed “five…

-

Interpreting and Applying IAS 11 – Construction Contracts

The interpretation and application of an accounting standard could be a complex task especially in those cases where a slightly…

-

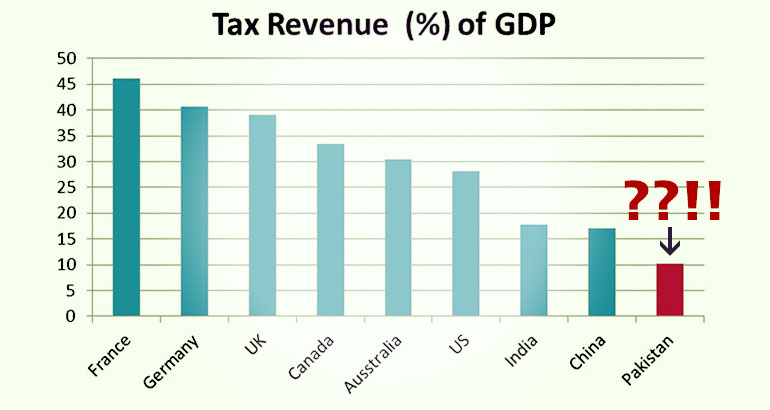

Fixing the Pakistani Tax System

The existential threat to Pakistan starts with the letter ‘T’. It’s ‘Taxes’. More precisely, it’s the lack of a fair…

-

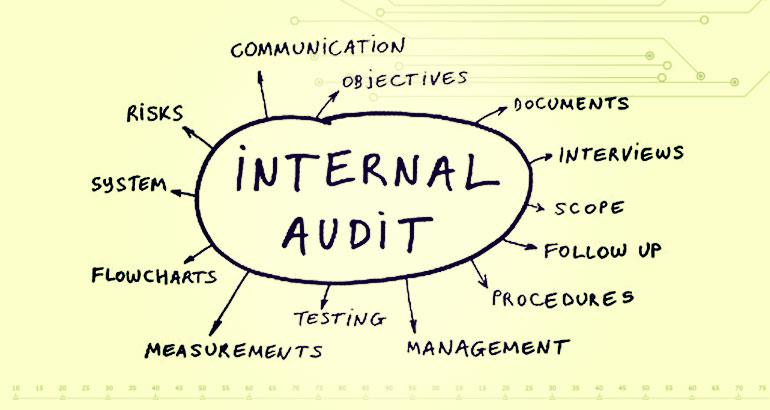

Internal Audit in the New Business Environment

United States public companies are navigating new reporting and monitoring demands arising from new regulation and societal trends. The Sarbanes-Oxley Act…

-

Our Stubborn Tax Culture

Even though the Federal Board of Revenue (FBR) appears determined to widen the tax net and is undertaking some unconventional…

-

Making Inter-corporate Financing Transparent

The Securities and Exchange Commission of Pakistan (SECP) has decided to streamline investments made by listed companies in associated firms,…

-

Are Tax Reforms Delivering?

The 1973 Constitution provides for eliminating all forms of exploitation on the basis of, ‘from each according to his ability,…