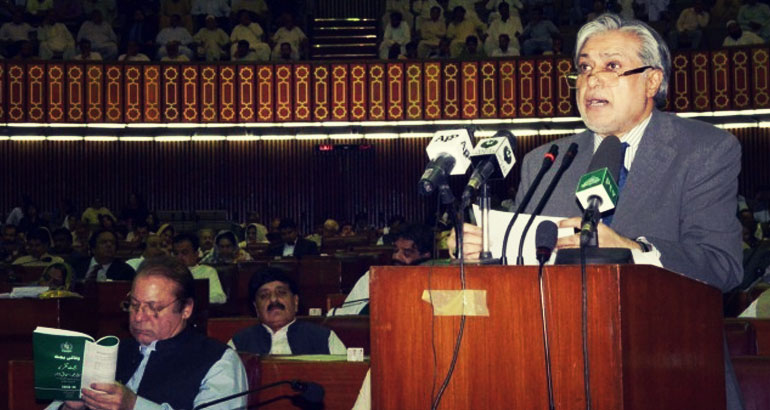

ISLAMABAD (June 23, 2014) – Several amendments were announced by Finance minister Ishaq Dar in the Finance Act 2014 which was passed on Saturday. The first amendment was related to tax on bonus shares through which every company which is not quoted on stock exchange and is issuing bonus shares to the shareholders of the company shall be required to deposit tax within 15 days of the closure of books at the rate of five percent of the value of the bonus shares.

It was also amended that if a shareholder neither makes payment of tax to the company nor collects its bonus shares within three months of the date of issuance, the company may proceed to dispose off its bonus shares to the extent it has paid tax on its behalf.

Another amendment was made to the Finance Bill through which the government has asked non-profit organizations to submit tax exemption certificate to be able to claim exemption from income tax.

Through another amendment, specific rates of federal excise duty (FED) were announced on air travel within the territorial jurisdiction of Pakistan. As per the act, the rate of FED will be Rs2,500 per passenger on long routes (journeys exceeding 500kms). Similarly, a rate of Rs1,250 will be applied on short routes. (journeys not exceeding 500kms and not belonging to social-economic routes)

Rate for socio-economic routes (routes along the Balochistan coastal belt) will be Rs500. For international routes, FED rate of Rs5,000 for economy and Rs10,000 for club, business and first-class will be applied.