General

- Opinion

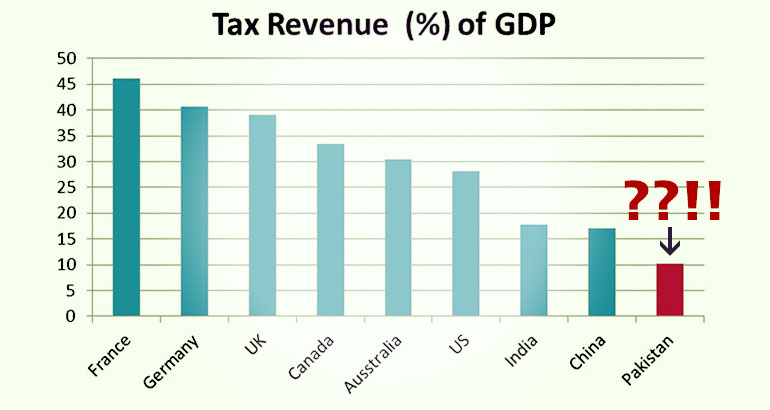

Fixing the Pakistani Tax System

The existential threat to Pakistan starts with the letter ‘T’. It’s ‘Taxes’. More precisely, it’s the lack of a fair…

- Opinion

Internal Audit in the New Business Environment

United States public companies are navigating new reporting and monitoring demands arising from new regulation and societal trends. The Sarbanes-Oxley Act…

- Opinion

Our Stubborn Tax Culture

Even though the Federal Board of Revenue (FBR) appears determined to widen the tax net and is undertaking some unconventional…

- Opinion

Making Inter-corporate Financing Transparent

The Securities and Exchange Commission of Pakistan (SECP) has decided to streamline investments made by listed companies in associated firms,…

- Opinion

Are Tax Reforms Delivering?

The 1973 Constitution provides for eliminating all forms of exploitation on the basis of, ‘from each according to his ability,…

-

SECP's Regulation Relaxation Spree

The Securities and Exchange Commission of Pakistan (SECP) is on a relaxation spree, amending rules and regulations governing the markets.…

-

Expanding Reach of Islamic Banks

With a futuristic approach, Islamic banks are now trying to find Shariah-compliant mode for overnight borrowings from the State Bank…

-

Regulators in Search of their Role

Financial regulators seem to be in search of their role far beyond the bee-line of notifications and circulars, as there…

-

The Shameful Tax Gap

The tax gap — the difference between sum of tax owed and amount of tax paid voluntarily and on time —…

-

Data Governance for Business Development

One of major contributor for effective monitoring of market trends, to gain competitive edge, innovate and achieve revenue growth, is…