Finance Act, 2004 – Students’ Perspective

While writing this article for students, I was pondering about my exam days when the seniors used to tell us that please don’t read the Finance Act. The reason is that it is not applicable for this attempt – The biggest examination preparation mistake I made at that time, believe me! If I have got the list of deleted items, my preparation would have become a lot easier. The reason is that such deleted items would not be examined in the paper and my studies would have become a lot easier – nevertheless, future should not be worse. However, students must be conscious about the nature of the deleted amendments – Conceptual, remedial or curative! This article is an endeavor to assess the amendments brought by Finance Act, 2004.

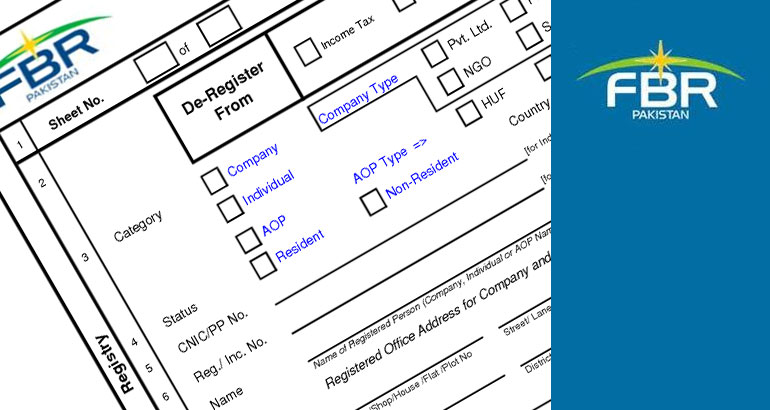

INCOME TAX ORDINANCE, 2001

The amendments brought into the Income Tax Ordinance, 2001 can be analyzed as follows.

Definitions

Amalgamation

The term amalgamation has been extended to Insurance companies apart from extension in date to on or before 30th Day of June, 2006. Now the amalgamation scheme is available to Banking Companies, Non-Banking Finance Company and Insurance companies.