Opinion

-

Empirically Analyzing the "Five Percent Rule of Materiality" in Financial Reporting Decisions

This study analyzes a sample of financial restatements from 2011 and 2012 as a way to assess a proposed “five…

-

Interpreting and Applying IAS 11 – Construction Contracts

The interpretation and application of an accounting standard could be a complex task especially in those cases where a slightly…

-

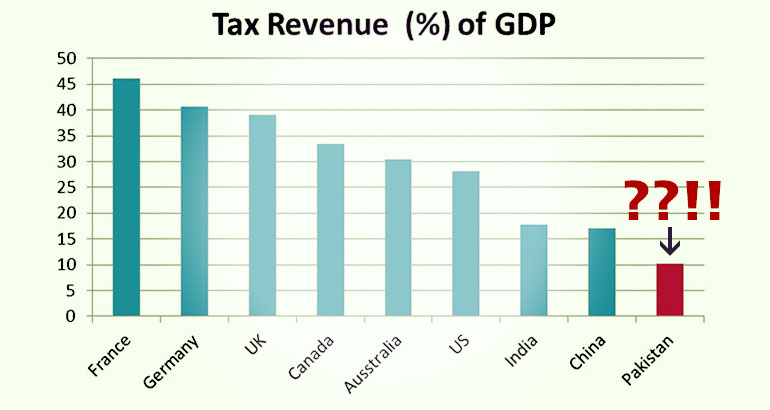

Fixing the Pakistani Tax System

The existential threat to Pakistan starts with the letter ‘T’. It’s ‘Taxes’. More precisely, it’s the lack of a fair…

-

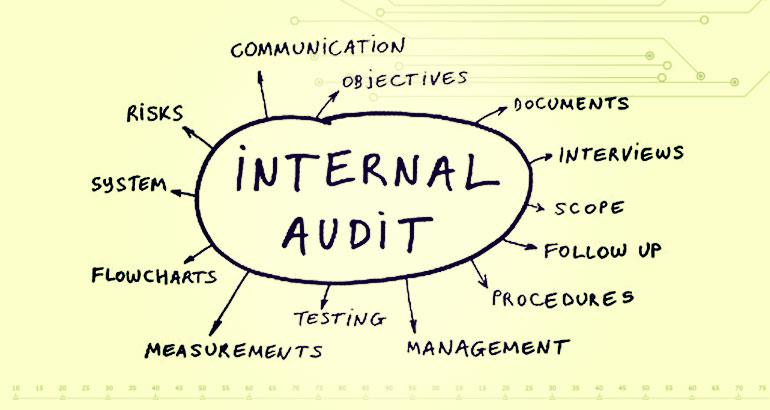

Internal Audit in the New Business Environment

United States public companies are navigating new reporting and monitoring demands arising from new regulation and societal trends. The Sarbanes-Oxley Act…

-

Our Stubborn Tax Culture

Even though the Federal Board of Revenue (FBR) appears determined to widen the tax net and is undertaking some unconventional…

-

Making Inter-corporate Financing Transparent

The Securities and Exchange Commission of Pakistan (SECP) has decided to streamline investments made by listed companies in associated firms,…

-

Are Tax Reforms Delivering?

The 1973 Constitution provides for eliminating all forms of exploitation on the basis of, ‘from each according to his ability,…

-

SECP's Regulation Relaxation Spree

The Securities and Exchange Commission of Pakistan (SECP) is on a relaxation spree, amending rules and regulations governing the markets.…

-

Expanding Reach of Islamic Banks

With a futuristic approach, Islamic banks are now trying to find Shariah-compliant mode for overnight borrowings from the State Bank…

-

Regulators in Search of their Role

Financial regulators seem to be in search of their role far beyond the bee-line of notifications and circulars, as there…